Piggy Bank: Parts of a Check

Piggy Bank: Parts of a Check

Piggy Bank: Parts of a Check

Last week we talked about how to fill out a deposit slip and what each section of the deposit slip indicated. Once that money is deposited into your account, you will likely, at some point want to spend it. While there are various methods to pulling money out of your account, one way is by writing a check. So, let’s take a look at the various parts of a check with the help of the folks at Hands on Banking again!

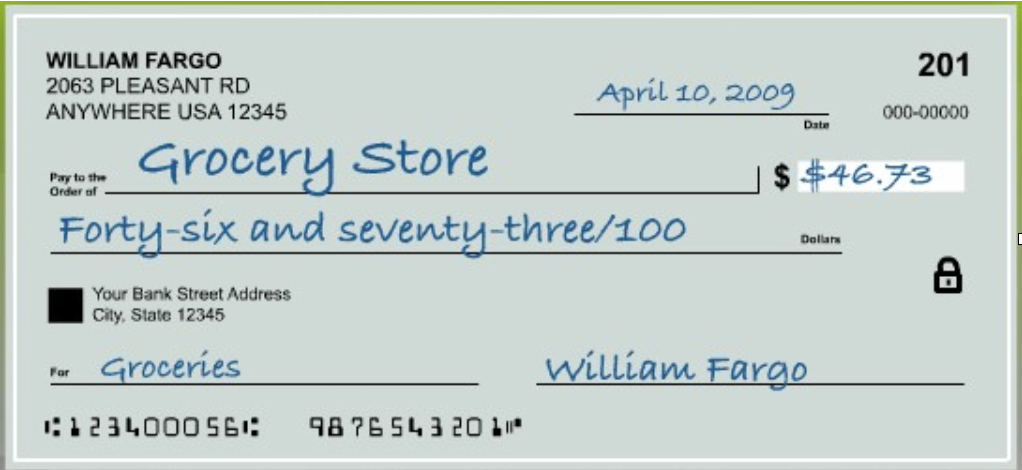

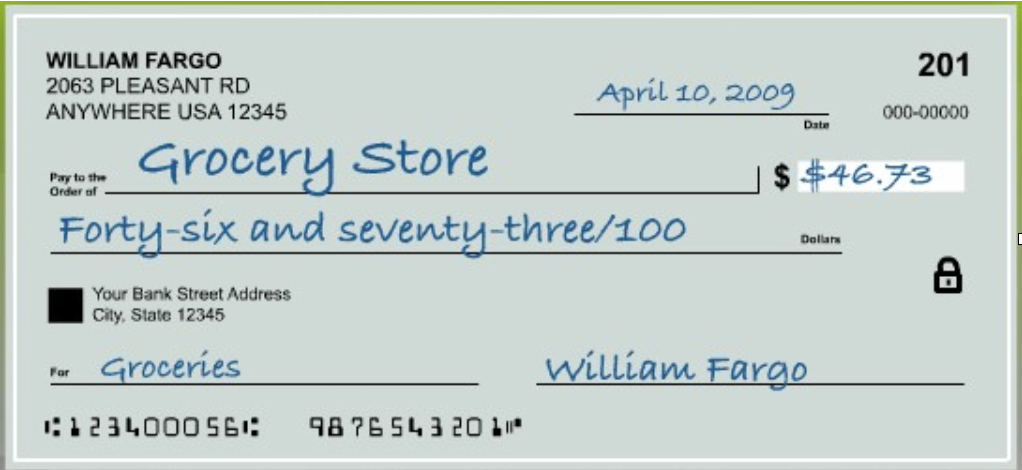

Source: https://www.handsonbanking.org/financial-education/wp-content/uploads/2012/11/YA_01_05_05_en.jpg

- Name and address: Your name and address are preprinted on the check for your convenience and tell the person or company to whom you’re giving the check. Sometimes this section is blank, particularly when you have just opened an account, it may take some time to get the pre-printed checks delivered to you.

- Date: This is where you write today’s date.

- Pay to the order of: This is where you write the name of the person or company who will be receiving the money. If you’re making a withdrawal for yourself, you will write “Cash” here.

- Numeric amount box: The amount of the check is written in this box.

- Written amount: The amount in words is written on this line. You start at the left edge of the line and when you’re finished, you will draw a line through the remaining empty space as far as the word “Dollars.”

- Bank name: The name of the bank that holds your account appears here.

- “For” or memo: To remember what you bought, you can write a brief description in the “for” area—other banks may label this area “memo.”

- Signature line: Your signature should be the last thing you complete. It gives the bank permission, or authorization, to release the money to the payee.

- Check number: This is the check number. This reference number will help you keep track of your payments by check. Each time you write a check, you should record the check number, date, payee, and amount in your check register, and calculate your new balance.

- Account number: This is the 10-digit account number that is unique to your account. This tells the bank which account the money comes from.

- Routing number: This is the bank routing number. It identifies the bank that issued the check. You need this number to set up direct deposit at work. Direct deposit allows your employer to electronically deposit your paycheck directly into your account, without giving you a paper check.

If you have additional questions, you should reach out to your local bank professionals, after all they are there to assist you! Taking this first big step in one’s financial future is exciting but with it comes responsibility of managing money so it would be a good idea to sit down with your young one at least once a month to review their check book/ balance so they understand where their money is being spent and as they save, commend them for doing so!

Source: https://handsonbanking.org/youngadults/getting-started/learn/the-parts-of-a-check/